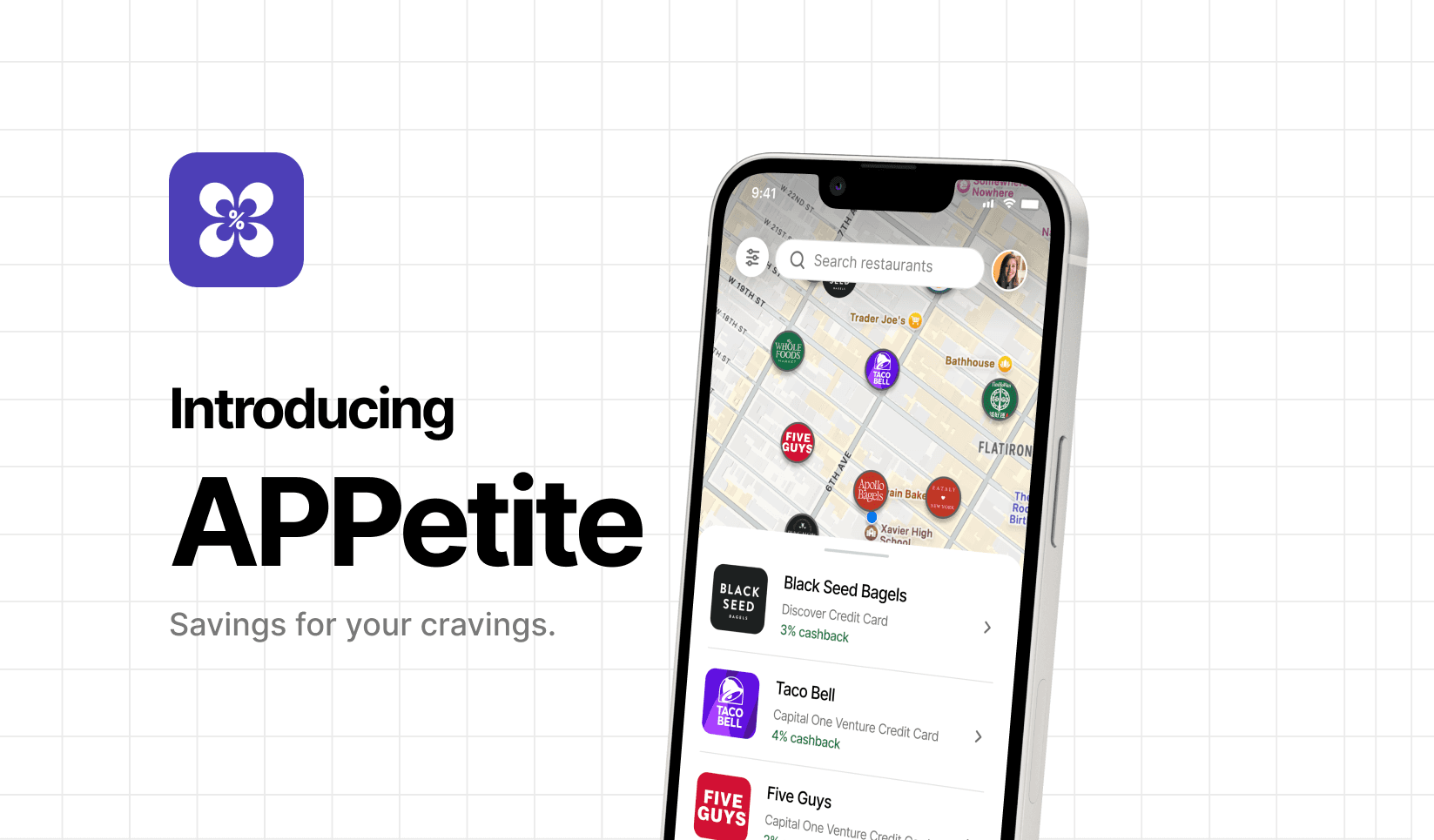

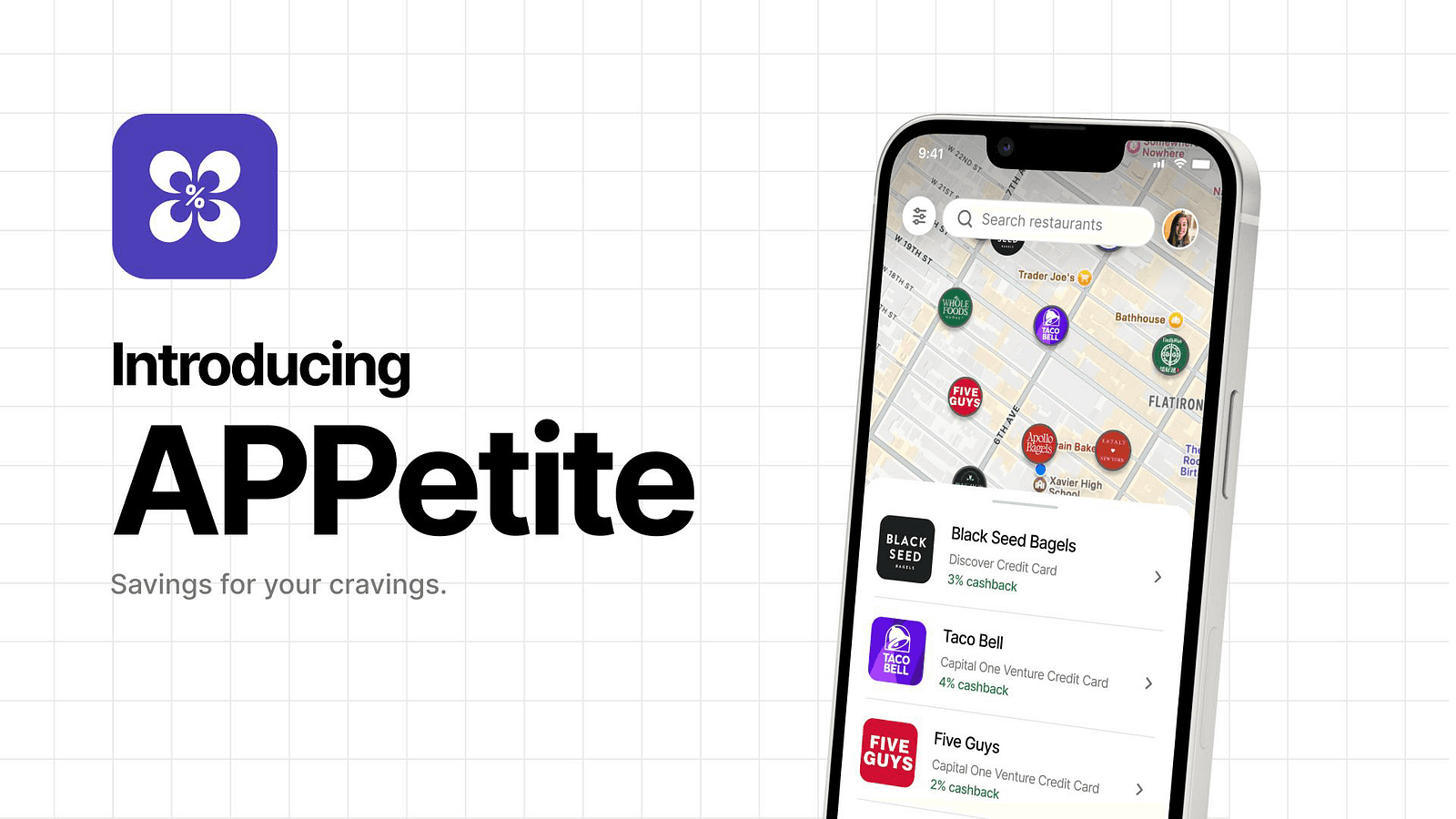

Frugal Foodies: Dining Cashback Rewards with Ease

———————————————————————————————————————————

Design Overview

———————————————————————————————————————————

APPetite is an app that helps users access their dining cashback rewards all in one spot. Rewards are automatically applied, and users can easily find the deal when they are checking out their food purchases.

Final Solution

———————————————————————————————————————————

Every nearby restaurant with an active offer is visible, so you can see where your cards can earn you rewards. APPetite automatically links your existing card offers and shows them on the map.

All your dining rewards, right on the map.

When you tap on a restaurant, APPetite ranks your linked cards and highlights the one with the best cashback offer.

APPetite automatically syncs offers, expiry dates, and cashback details; no manual tracking needed.

Rewards are grouped by urgency. “Expiring Soon” surfaces deals ending soon so you won't miss out on these benefits.

Your linked cards are ranked based on usage and rewards activity, with a summary of total savings and deals per card.

Know which card saves you the most.

View your credit cards in one place.

Deals are prioritized automatically.

Track your rewards and savings.

The Problem

———————————————————————————————————————————

You’ve just arrived at Chipotle for your lunch break, remembering that there may be a cashback deal here. However, you get to the front of the checkout line, scramble through multiple banking apps, and compare cashback deals, all while holding up the line behind you. You give up and pay with what you thought was the best option at the time — a card that gave you 3% cashback on dining purchases. The screen finally loads after you pay, only for you to find a better, 7% cashback reward.

As a matter of fact, the frustration with finding and manually adding cashback rewards is what we also found throughout our users.

User Research

———————————————————————————————————————————

We were tasked to create a solution for the following:

Optimize a user’s purchases and savings through their existing credit card and bank account benefits.

This prompt was pretty broad, so we got right to work on narrowing down a specific angle we wanted to tackle. First, we interviewed three users who were young adults in their mid-late 20s, carried multiple credit cards, and often used cashback rewards while eating out. We wanted to learn more about:

Users’ purchase and saving decision-making when making a food purchase

Pain points users may encounter while trying to save money and navigate through banking apps

How users keep track of their cashback rewards.

Here are some of the responses that were given by our interviewees:

“I try to remember which card gives the best cashback at which place, but I mess it up and pay with the wrong one.”

“I’ll look for a reward, but it takes me so long to get to it that I just pull out the nearest card. I wish I could see the rewards more easily.”

“Everything feels scattered. I have Capital One, Chase, Amex, and Citi, each with its own app. I forget what’s where, get frustrated, and sometimes give up.”

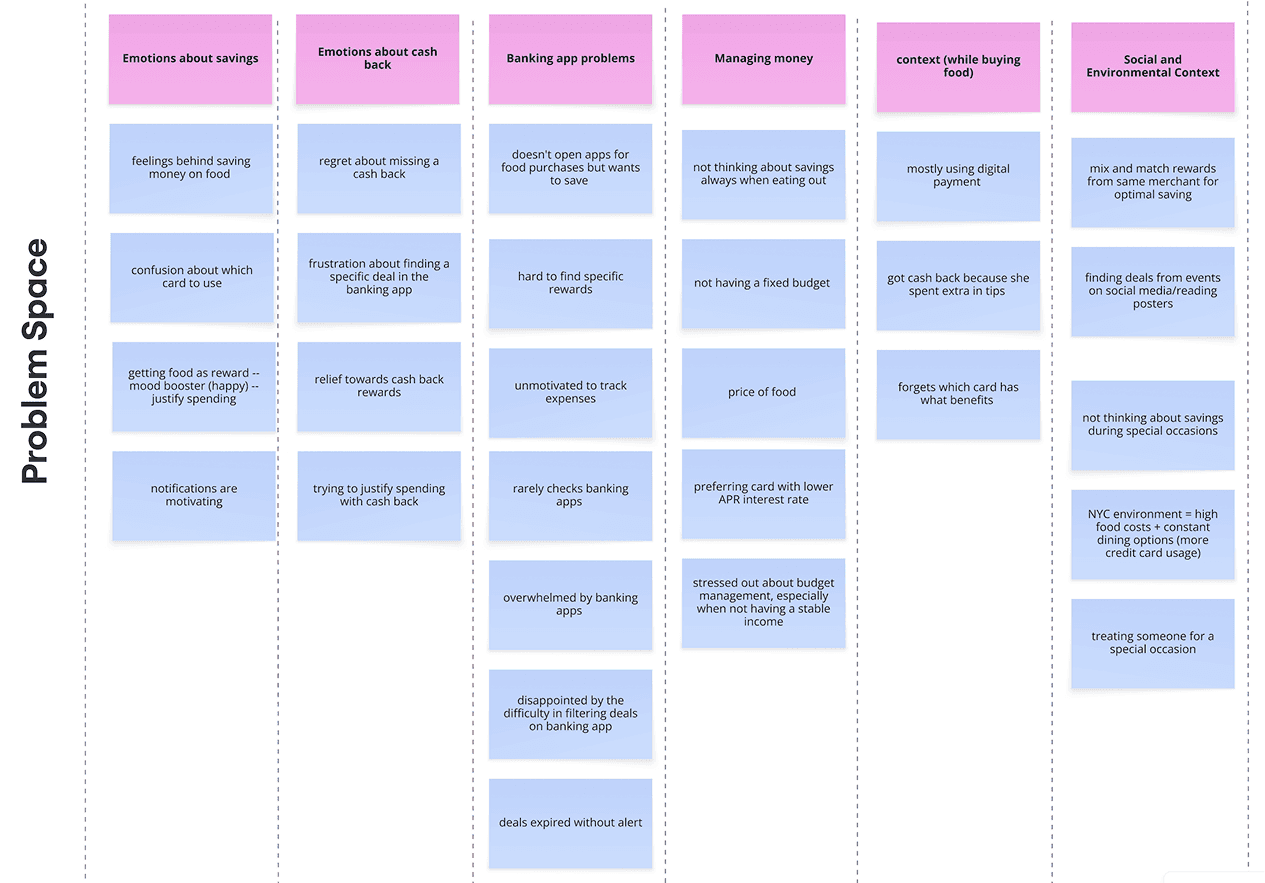

After interviewing users, we created a mental model to organize the information that we’ve collected. Below is the mental model that illustrates the problem space.

From building our mental model, we found the following insights about cashback rewards on banking apps:

In short, users wanted a way to use cashback rewards without having to scramble through their banking apps and keep track of expiration dates. Overall, these insights motivated us to design an app that is built on convenience and personalization.

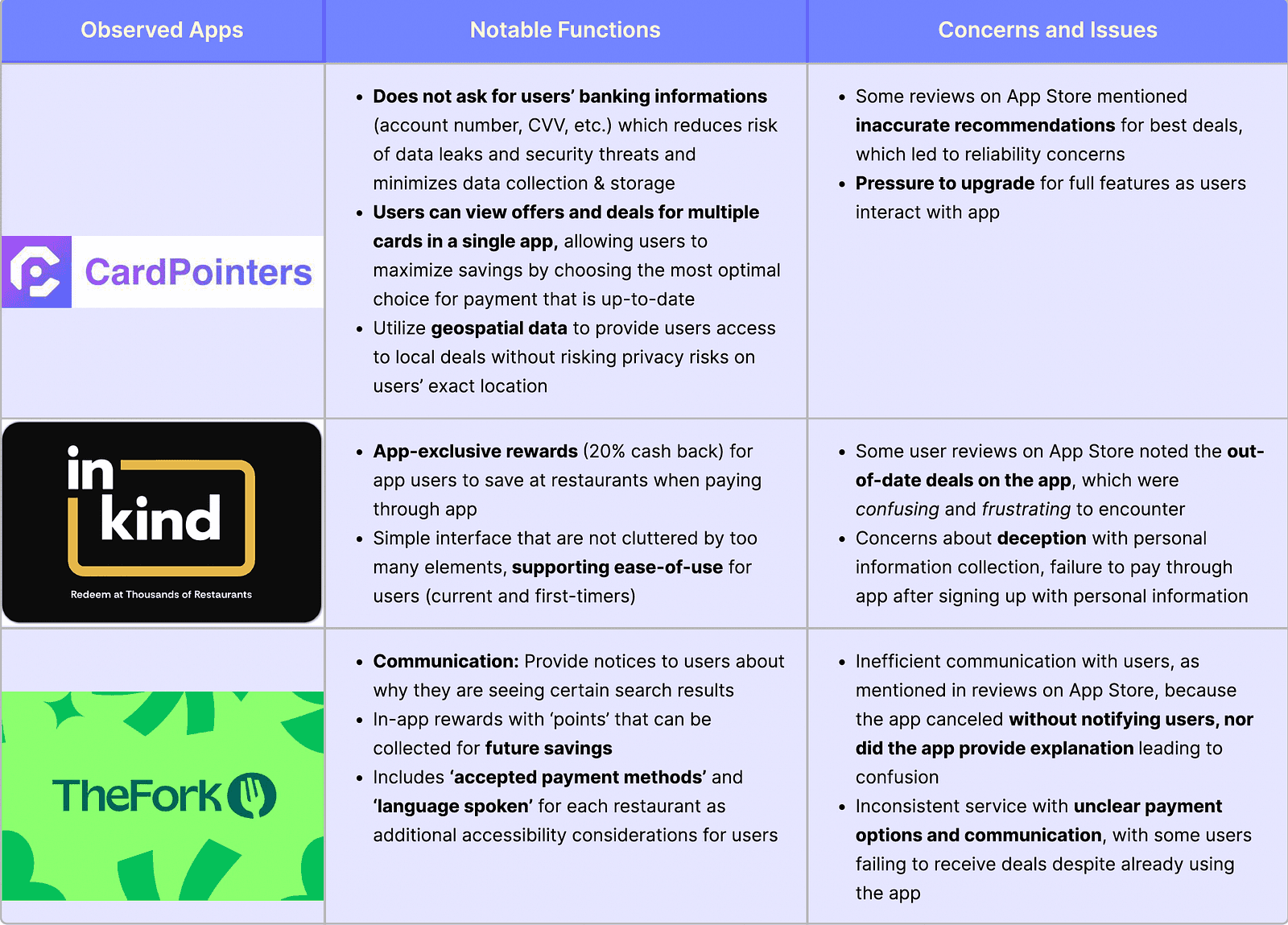

Competitive Analysis

———————————————————————————————————————————

We conducted a competitive analysis to confirm that our app design was unique. Based on these interests, we chose to engage with 3 apps:

CardPointers: An app that allows users to utilize card rewards for optimal purchasing decisions.

InKind: An app that offers in-app deals and payment options with a tailored range of restaurants to accommodate users’ needs.

The Fork: An app that offers reservations and deals, with a focus on rewards from dining out and in-app offers.

Reflecting on our findings, there is no single solution that uniquely addresses the features and concerns that meet our users’ needs. Our design was built on location and situational intelligence, whereas existing designs were centered around the card rewards themselves.

Finally, we devised our design goal:

Create an app that enables users to more easily use their best available dining cashback offers during checkout, and allow credit card users to search for rewards based on location.

Along with the design goal as our North Star, these were the design features that we came up with, as well as the reasoning behind each feature:

1. Map + Best Card

Addresses the need for deciding which card gives the best reward. Helps users decide quickly while dining out.

2. Summary of Savings

Encourages small wins and control.

3. Favorite Dining Places

Makes frequent choices faster and more relevant for repeat restaurant visits.

4. Filters & Search Options

Let users easily explore deals based on cuisine or location.

5. Positive Reinforcement Messages

Builds motivation to keep using the app and emotional satisfaction after saving.

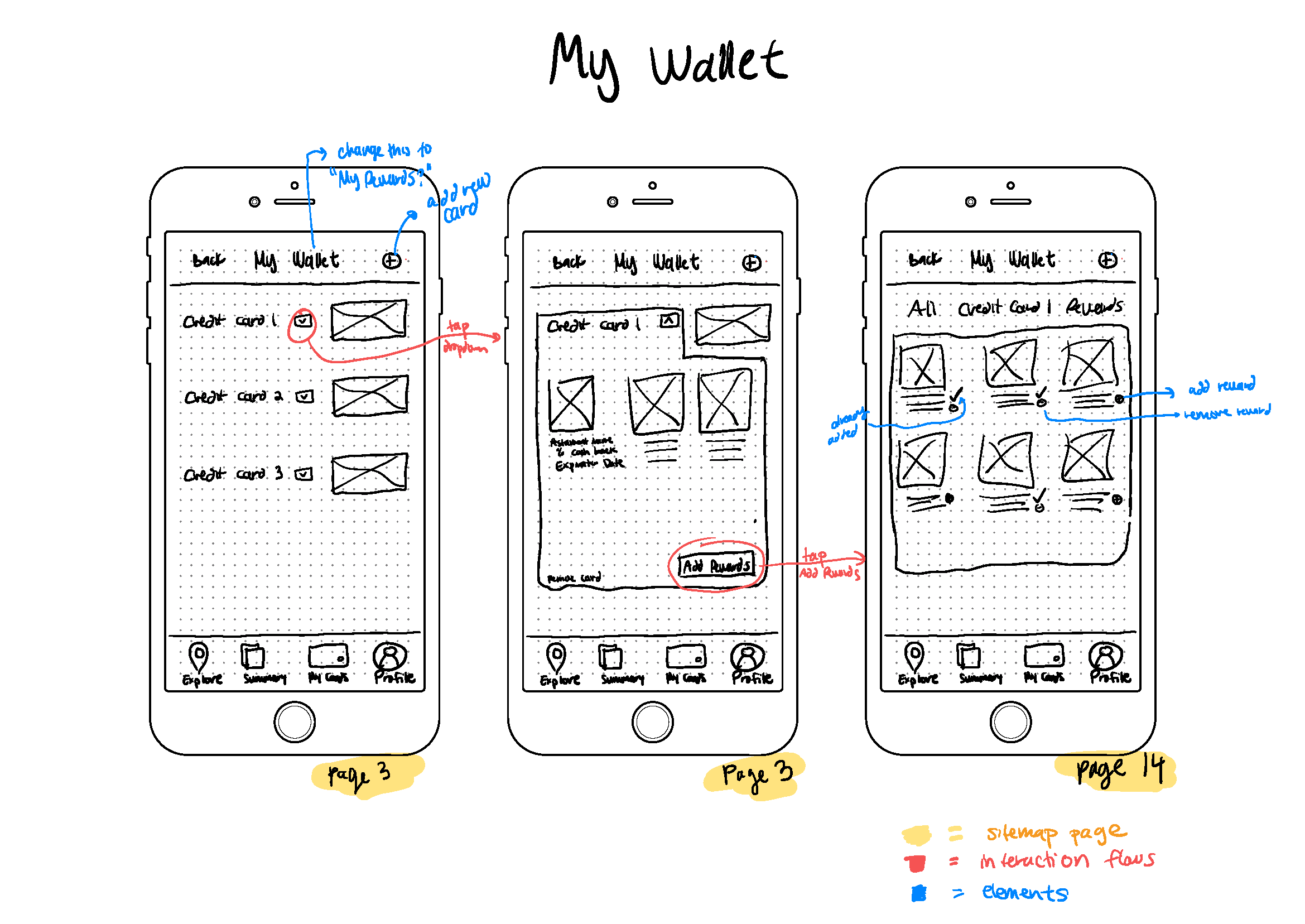

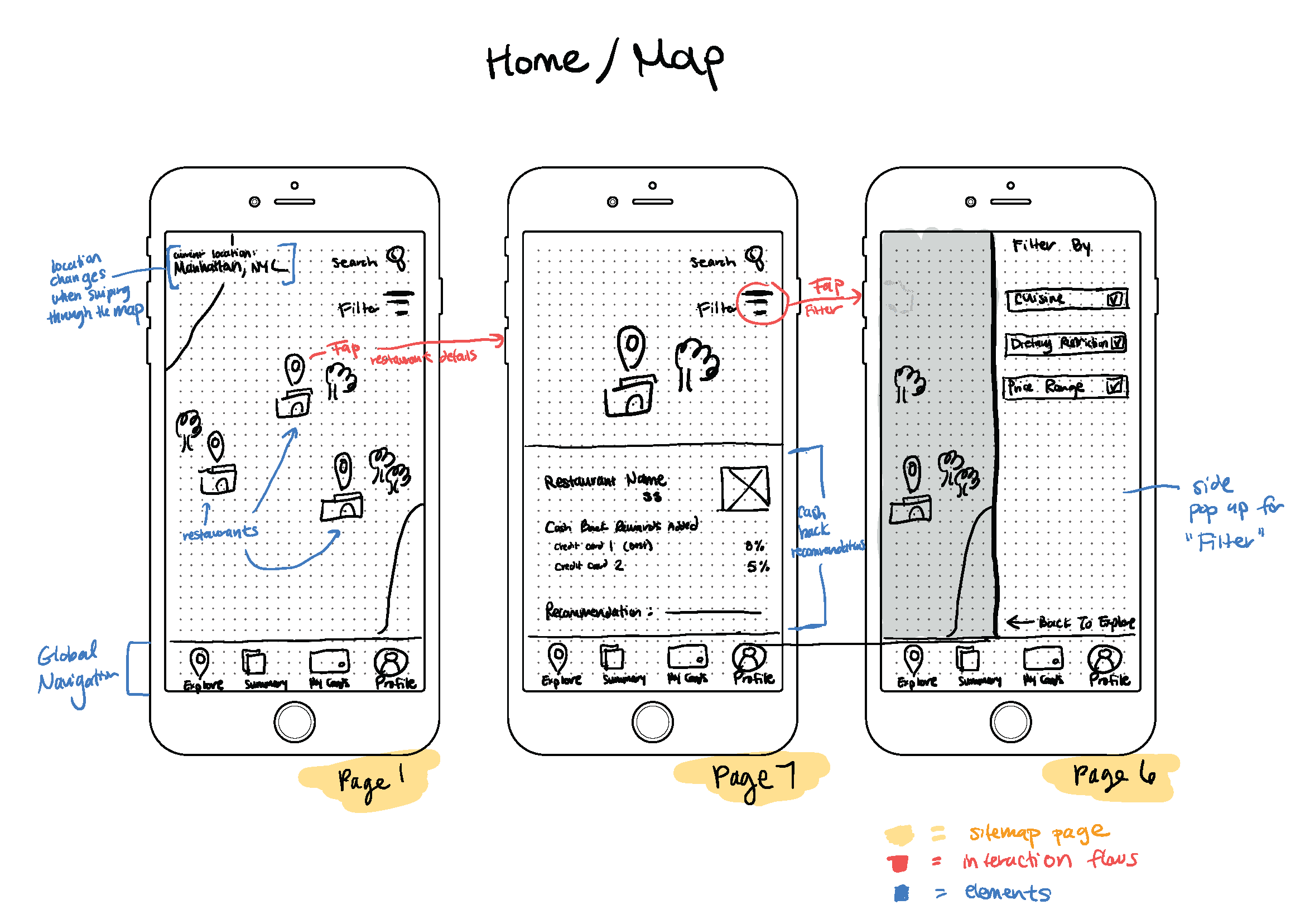

Home/Maps

Gives the user the most convenient way to search and use their cash back rewards for restaurants on the go, taking advantage of situational intelligence in our design.

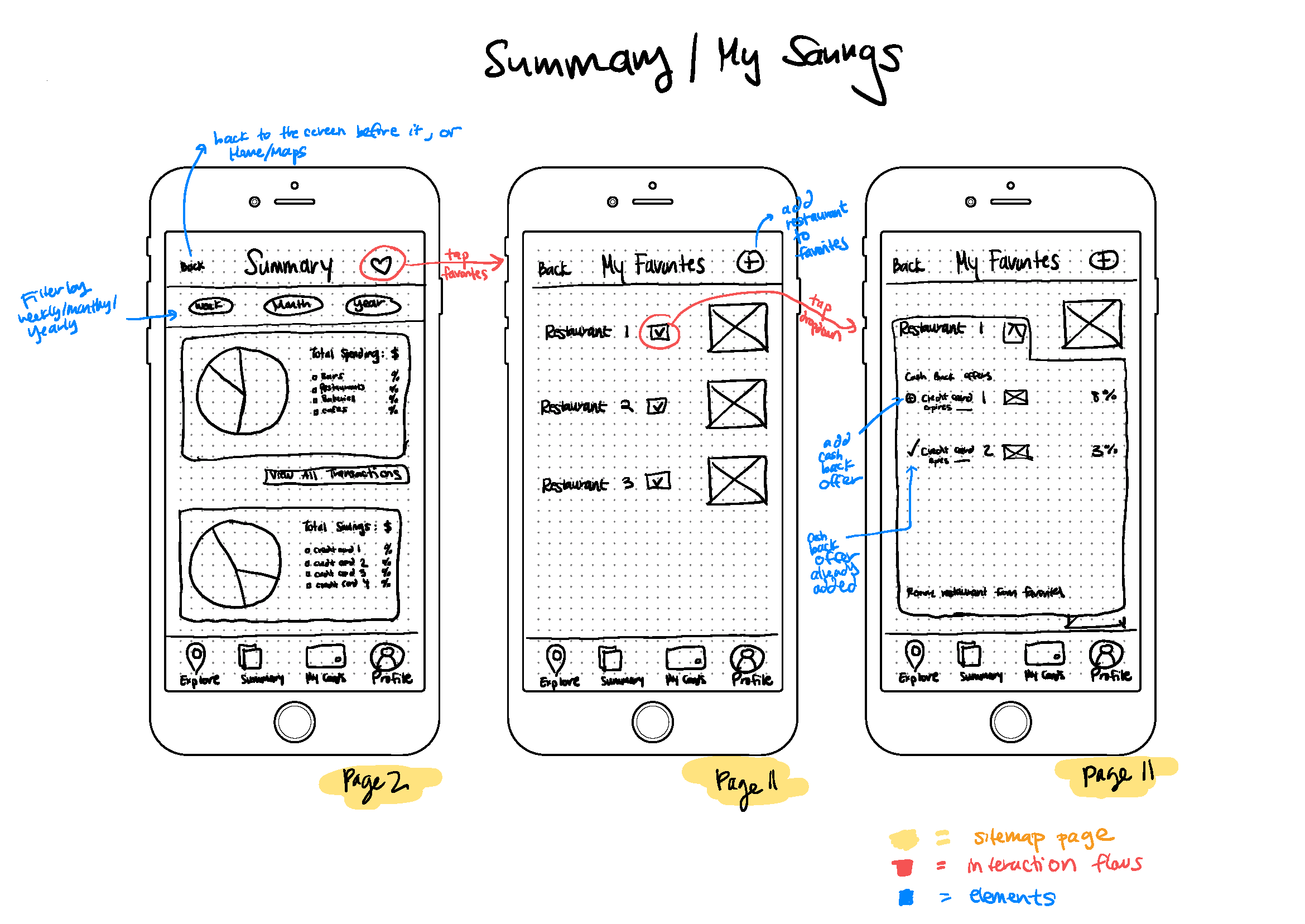

Savings

Users could see their savings progress and a list of transactions.

Cards

Users’ cash back rewards are automatically added after linking their bank account(s), saving the headache of having to search within each banking app and add the reward manually.

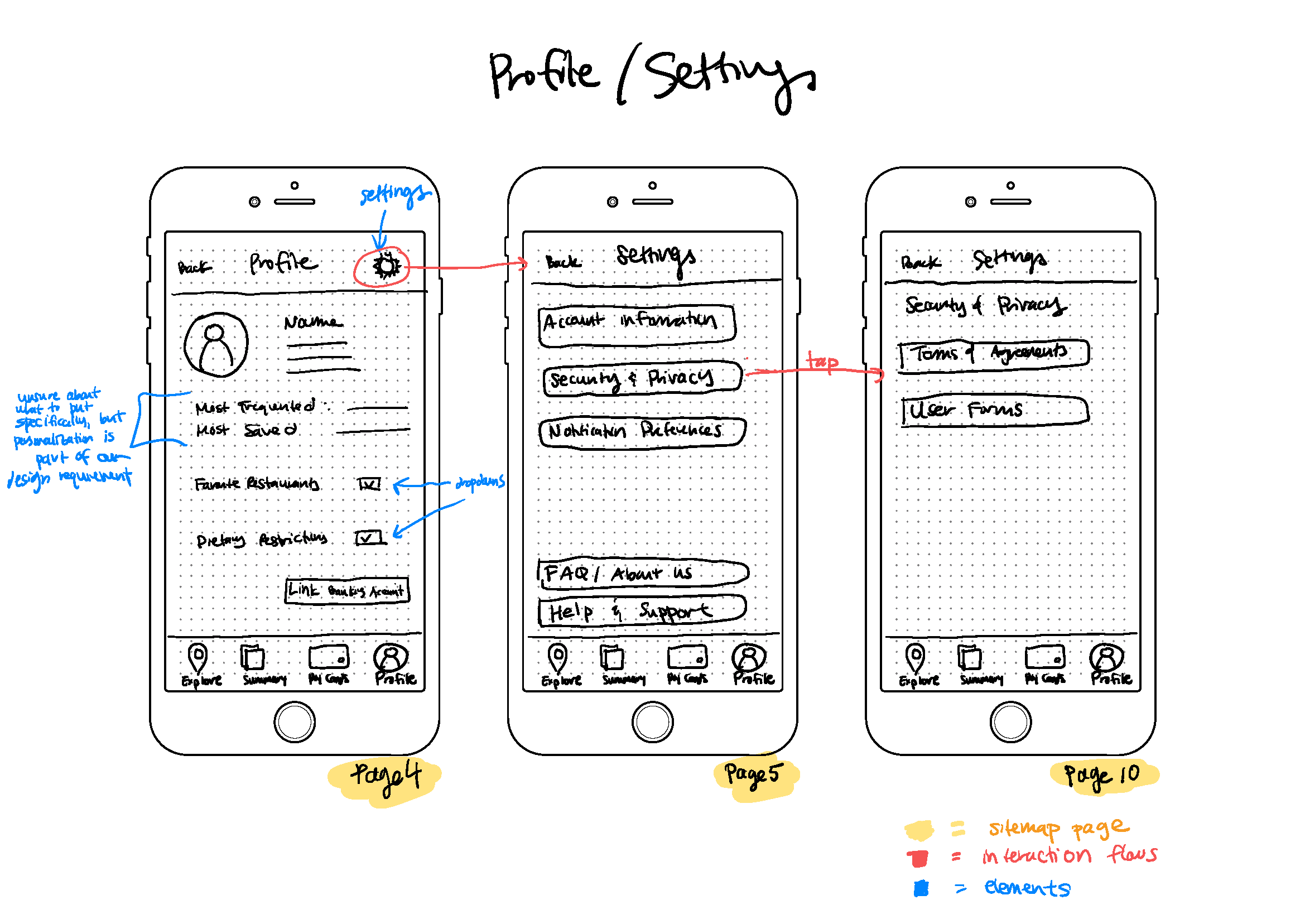

Ideation: Wireframes

———————————————————————————————————————————

Here are the wireframes that we’ve sketched, based on our design goals and features that we’ve delineated above. We chose to focus on the following main pages for the app’s global navigation:

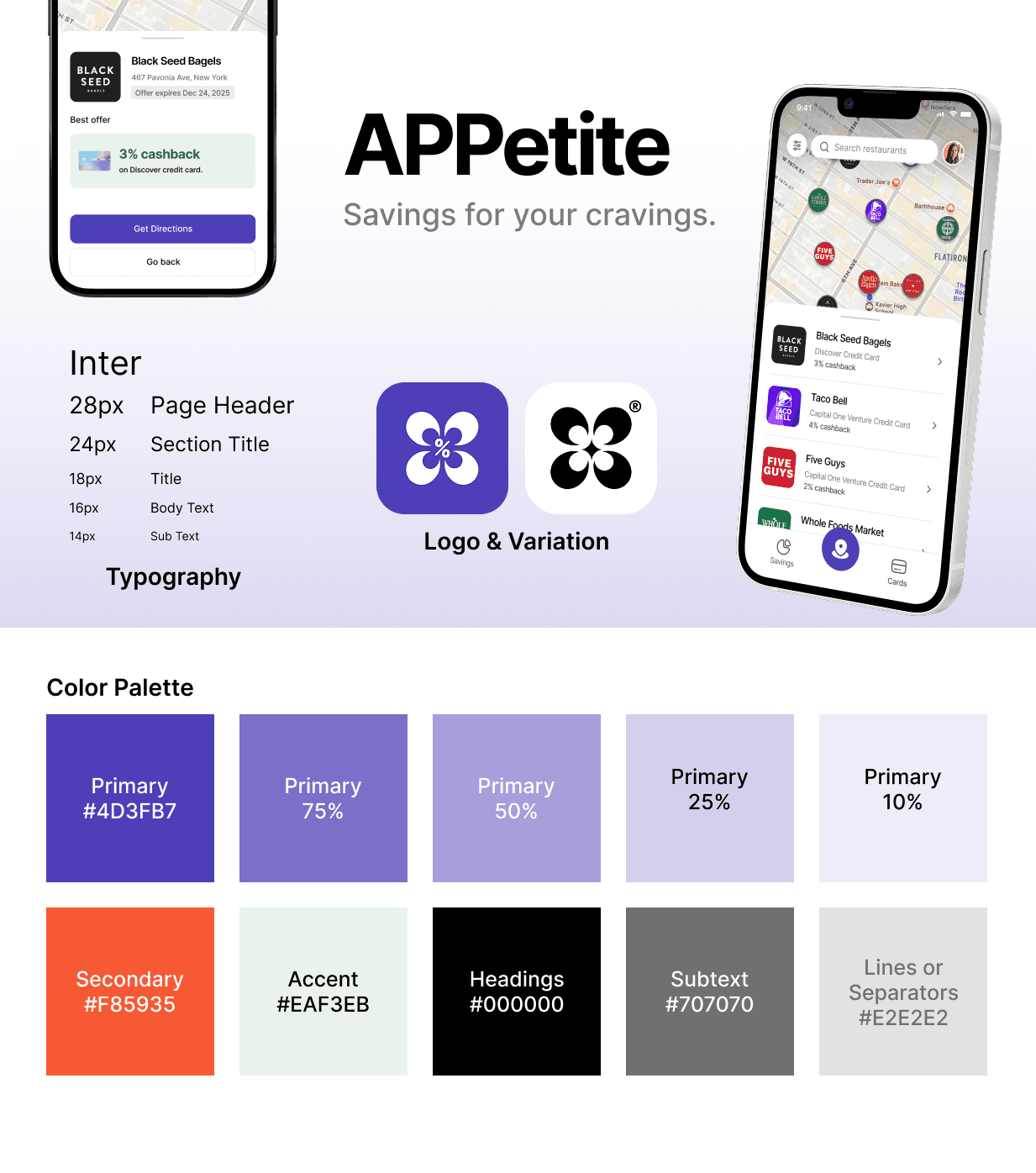

Branding

———————————————————————————————————————————

As visualization was an important factor for an attractive app, according to our user interviews, we spent time building a fresh, modern color palette— purple, green, and orange — to design our app. After researching trends that were popular among users in our demographic, we came up with the branding guidelines below:

In our logo, we wanted to capture the ideas of “savings,” “cashback,” and “dining.” The logo displays four chairs around a percent sign, representing diners sitting at a table, in the shape of a clover, representing good fortune.

Here were some of the rejected logo ideas that didn’t quite fit the mood we wanted to capture with APPetite:

Usability Testing and Feedback

———————————————————————————————————————————

We conducted usability testing with our hi-fi prototypes on two individuals in their mid-20s. In our tests, we were looking to see if users were able to complete the task flow in accessing their rewards, based on their real-time location. We were curious if there were other pain points that we may have missed in our research. Here were the results:

Participant 1:

Noted the intuitiveness of their experience: the interfaces were easy to follow, and they felt compelled to engage with the interfaces further.

Found the visualization at the top of the screen in the ‘Savings’ page useful because it provided quick insights into their transaction activities. They noted that the banking apps don’t have such visualizations upfront, which would take them more time to find.

Participant 2:

Was particularly interested in the visualizations on the ‘Savings’ page: seeing graphs that summarize spending details quickly gave them insights into saving activities.

Highlighted the importance of visual contrast in the graphs and the facets across interfaces: stronger contrast between items that are close to each other helped them stand out more.

Overall, both participants noted the abundance of contextual information for each page, which was engaging but not overwhelming or disruptive. Thus, we made minimal changes to our hi-fi prototypes.

Takeaways

———————————————————————————————————————————

Working with ambiguous problems. As our group’s prompt was broad, we had the freedom to be creative with our solution. This was also a benefit and a potential pitfall, as a solution that is too creative could be at risk of being impractical. Through this project, we learned to prioritize important insights from irrelevant ones, determining which problems are important and which ones are insignificant to tackle within nine weeks.

More usability testing. Even though this project had “ended,” I still have questions floating in the back of my mind. Would a different visual, such as a pie chart, be better suited for visualizing savings? Is the top-left side of the screen really the most intuitive place for the filter icon? What if a user is eating out for a special occasion and doesn’t want to be reminded of savings? Besides collecting more data in general, I am curious about how users who only use one or two credit cards would respond to the interface.

Embrace the joy of the process. While I’ve learned about the design process as a linear series, the progression of our project was far from linear. After all, having fun with this design process was how my group and I were able to discover insights that wouldn’t have been uncovered if we were more rigid in our approach. For instance, the idea of automating adding rewards into APPetite came much later, while we were building our hi-fi prototypes. Additionally, as tempting as it was to hash out every interview at once and leave it behind, I found myself interviewing users even while we were iterating our prototypes. Working on this project was a sobering reminder to be serious about my work without taking myself too seriously.

Shoutout to my team members, Debo and Julie, for working with me, the late-night jokes we’ve shared, and contributing their visual design expertise to this project!